The World of Hospitality

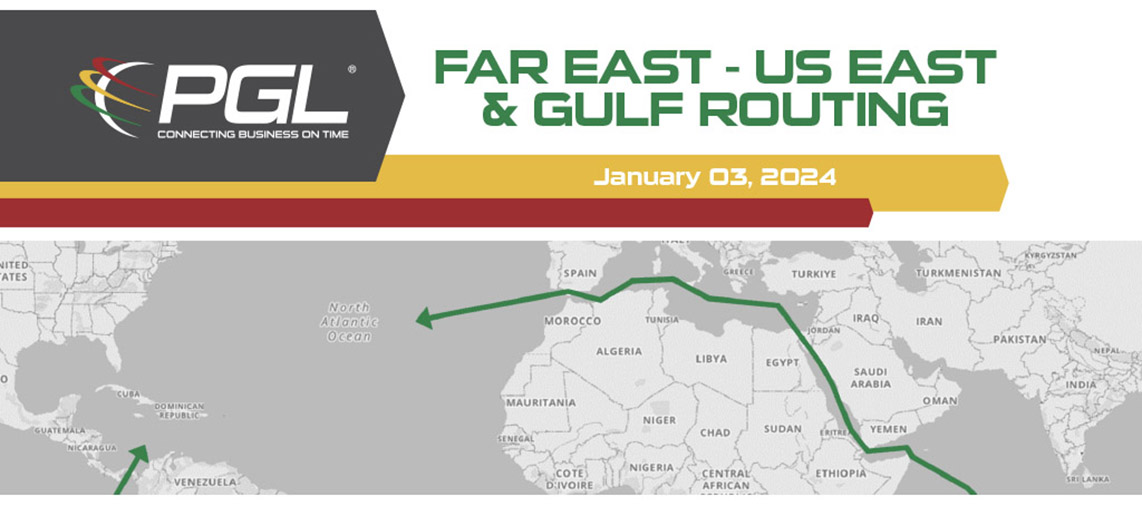

In the bustling world of hospitality, where every detail matters, the pursuit of excellence is not merely an aspiration but an expectation. Just as a master chef meticulously crafts each dish or a concierge orchestrates a seamless guest experience, at PGL (Perimeter Global Logistics), we understand the intricate role of logistics within the hospitality sector. With our comprehensive suite of services, we don’t just deliver goods; we curate experiences, elevate spaces, and ensure that every element aligns flawlessly to create unforgettable moments.

Quality Service

At the heart of our approach lies a commitment to quality

that echoes the sentiments of writer and philosopher John Ruskin: “Quality is never an accident. It is always the result of an intelligent effort.” You can see intelligent effort in everything we do at PGL. From the moment we engage with a client to the final delivery and beyond. Just as a masterful host anticipates the needs of their guests, we anticipate the needs of our clients and tailor our services to exceed their expectations. PGL seamlessly coordinates between designers, contractors, and vendors to bring visions to life. From handling large furniture to delicate fixtures, our expertise in FF&E (Furniture, Fixtures, and Equipment) and OS&E (Operating Supplies and Equipment) ensures that every element is delivered with precision and care.

PGL’s Project Prowess

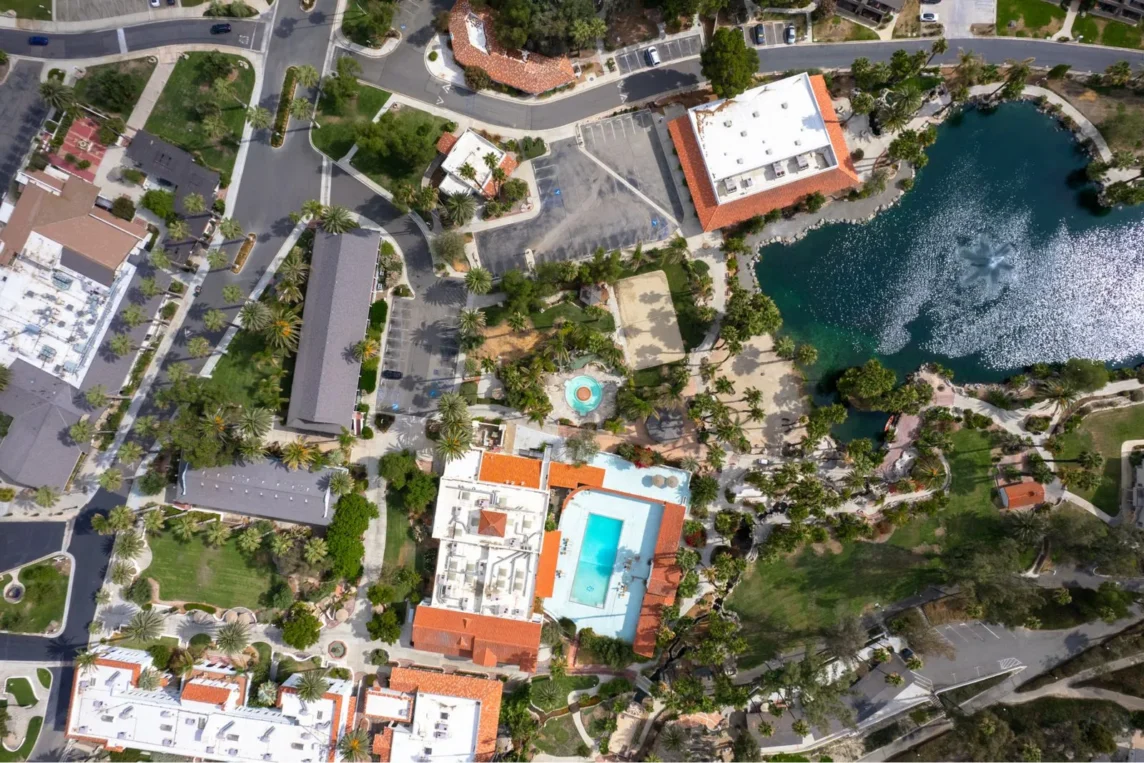

Take, for example, the Murrieta project, where PGL’s logistical prowess was put to the test. With tight deadlines and high expectations, our team choreographed the various components of the projects, ensuring that each element arrived punctually and in impeccable condition. From coordinating international shipments to organizing white-glove deliveries, we left no stone unturned in our pursuit of excellence.

A Commitment to Quality

But our commitment to quality extends beyond logistics; it’s ingrained in our culture. Just as a renowned chef selects the finest ingredients, we handpick our partners and suppliers to ensure that every aspect of our service meets the highest standards. Whether it’s shipping and crating or installation and removal, our attention to detail sets us apart as a trusted partner in the hospitality industry.

In a world where every interaction is an opportunity to make a lasting impression, PGL stands as a beacon of reliability and excellence. Just as a memorable stay leaves guests longing to return, our seamless logistics solutions leave clients confident in their choice to entrust their supply chain to us. From domestic freight to global shipping, from warehousing to liquidation, PGL is more than a logistics company; we’re a partner in the pursuit of perfection.

So, whether you’re a boutique hotel embarking on a renovation or a global resort launching a new property, trust PGL to deliver more than just goods—we deliver experiences. Because, as John Ruskin so eloquently stated, excellence is not an accident; it’s a deliberate choice, and at PGL, we choose excellence every step of the way.

Case Study

Learn more about the Murietta Springs Hotel Case Study and uncover the secrets behind our success in delivering excellence.